Services

News & opinion

Are you ready for mandatory disclosure?

As of 1 January 2021, reportable cross-border arrangements need to be reported with the Dutch tax authorities. For these reports, a term of 1 month (for arrangements from 1 July 2020 up to and including 31 December 2020) or 2 months (for arrangements from 25 June 2018 up to and including 30 June 2020) applies. Are you aware of what has to be reported, but also what does not have to be reported?

Read more

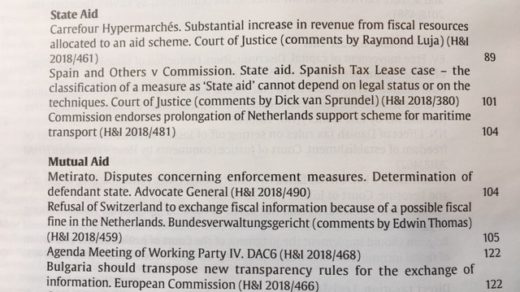

Comment in Highlights & Insights regarding the Spanish Tax Lease case

Dick van Sprundels comments to the Court of Justice EU case regarding the Spanish Tax Lease case was published in Vakstudie Highlights & Insights in December 2018, issue 12. In brief, a classification of a measure as state aid cannot depend on legal status or on the techniques. European Court of Justice dated 25 July 2018 – European Commission – Kingdom of Spain and several Spanish banks and Spanish leasing companies, no. C 128/16 P

Read more